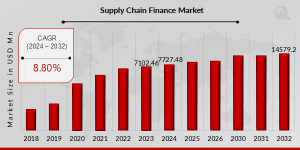

Supply Chain Finance Market to Reach USD 14,579.2 Million by 2032 | Expected CAGR 8.80% (2024–2032)

Supply Chain Finance Market Research Report By, Type of Financing, Industry Vertical, Company Size, Deployment Model, Integration, Regional

NE, UNITED STATES, August 18, 2025 /EINPresswire.com/ -- The global Supply Chain Finance Market has witnessed significant growth in recent years and is projected to expand rapidly in the coming decade. In 2023, the market size was estimated at USD 7,102.46 million and is expected to grow from USD 7,727.48 million in 2024 to an impressive USD 14,579.2 million by 2032, reflecting a robust compound annual growth rate (CAGR) of 8.80% during the forecast period (2024–2032). The growth is primarily driven by increasing demand for working capital optimization, adoption of digital financing solutions, and expansion of global trade networks.Key Drivers Of Market Growth

Working Capital Optimization- Businesses are leveraging supply chain finance solutions to improve liquidity, reduce financing costs, and enhance cash flow management. This is particularly critical for large-scale enterprises with complex supply chains.

Digital Transformation in Finance- The integration of blockchain, AI, and cloud-based solutions has streamlined supply chain finance processes. Digital platforms enable real-time tracking, faster payments, and improved transparency, making finance operations more efficient.

Global Trade Expansion- Growing cross-border trade and globalization have increased the need for financing solutions that bridge gaps between suppliers and buyers. Supply chain finance helps businesses manage international payments and mitigate risks associated with global transactions.

Technological Advancements- Innovations such as AI-driven risk assessment, predictive analytics, and automated invoice processing have enhanced operational efficiency and reduced fraud risks in supply chain finance solutions.

Get a FREE Sample Report – https://www.marketresearchfuture.com/sample_request/24696

Key Companies in the Supply Chain Finance Market Include

• HSBC Holdings

• JPMorgan Chase & Co.

• Citibank

• BNP Paribas

• Standard Chartered

• Barclays

• ING Group

• Santander

• Deutsche Bank

• UBS

• Wells Fargo

• BNY Mellon

• Goldman Sachs

• Commerzbank

• Bank of America, among others

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/supply-chain-finance-market-24696

Market Segmentation

To provide a comprehensive analysis, the Supply Chain Finance market is segmented based on type, application, and region.

1. By Type

• Reverse Factoring: Buyer-led financing that improves supplier liquidity.

• Supplier Finance: Supplier-led programs offering flexible financing options.

• Dynamic Discounting: Early payment solutions for discounted invoices.

• Inventory Finance: Financing based on inventory holdings and management.

2. By Application

• Manufacturing: Optimizing capital for raw material procurement and production processes.

• Retail & E-commerce: Financing solutions for inventory management and supplier payments.

• Automotive: Supporting suppliers in maintaining production efficiency and reducing financing costs.

• Healthcare & Pharmaceuticals: Ensuring uninterrupted supply and cash flow for critical products.

3. By Region

• North America: Leading market due to early adoption of supply chain finance solutions and advanced financial infrastructure.

• Europe: Growth driven by regulatory support, digital banking solutions, and corporate finance trends.

• Asia-Pacific: Fastest-growing region, fueled by industrial expansion, e-commerce growth, and SME adoption.

• Rest of the World (RoW): Steady growth expected in Latin America, the Middle East, and Africa due to emerging trade networks and financial inclusion initiatives.

Purchase Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24696

The global Supply Chain Finance market is on a trajectory of strong growth, driven by increasing demand for liquidity management, digital finance adoption, and global trade expansion. As enterprises focus on optimizing working capital and mitigating supply chain risks, the market is poised to play a crucial role in shaping the future of corporate finance through 2032.

Top Trending Research Report :

Commercial Payment Cards Market - https://www.marketresearchfuture.com/reports/commercial-payment-cards-market-23869

Credit Card Issuance Services Market - https://www.marketresearchfuture.com/reports/credit-card-issuance-services-market-23888

Credit Card Payment Market - https://www.marketresearchfuture.com/reports/credit-card-payment-market-23915

Debit Card Market - https://www.marketresearchfuture.com/reports/debit-card-market-23925

Emv Smart Cards Market - https://www.marketresearchfuture.com/reports/emv-smart-cards-market-23876

Forex Cards Market - https://www.marketresearchfuture.com/reports/forex-cards-market-23847

Prepaid Cards Market - https://www.marketresearchfuture.com/reports/prepaid-cards-market-23856

Virtual Cards Market - https://www.marketresearchfuture.com/reports/virtual-cards-market-23880

Aviation Insurance Market - https://www.marketresearchfuture.com/reports/aviation-insurance-market-23897

Cancer Insurance Market - https://www.marketresearchfuture.com/reports/cancer-insurance-market-23920

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.